Retreat Guru Has Been Helping Retreat Leaders

Since 2014

$

750

+

Million in Payments

2

M+

Registrations to Date

1

M+

Nights Booked

Spend Less Time Worrying About Your Day-to-Day

Our retreat management software seamlessly integrates with websites hosted on Wordpress, Wix, and Squarespace to make it even easier to manage your retreats and accept more bookings.

.png?width=1216&height=999&name=Group%201000001113%20(2).png)

Simplify the Booking Process

Collect all the information you need to run retreats while offering guests a better booking experience

- Allow Multiple People to Book at Once

- Show Your Real-Time Bookable Room Inventory

- Add Custom & Conditional Questions to Your Forms

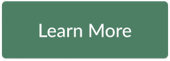

Automate Tasks to Save More Time

Let Retreat Guru handle time-consuming and repetitive tasks so you are free to focus on the guest experience.

- Send Pre-Arrival & Departure Email Campaigns

- Automatically Send Guest Statements for Payment

- Make it Possible to Book Rooms With Programs

.png?width=1275&height=1327&name=Group%201000001131%20(2).png)

Fill Your Retreats & Sell More

Get rid of barriers that stop people from booking by offering extra flexibility to your guests.

- Keep Track of “Abandoned Cart” Leads & Use a Wait List

- Easily Collect Rental Inquiries & Manage Contracts

- Allow Guests Pay in Monthly Instalments

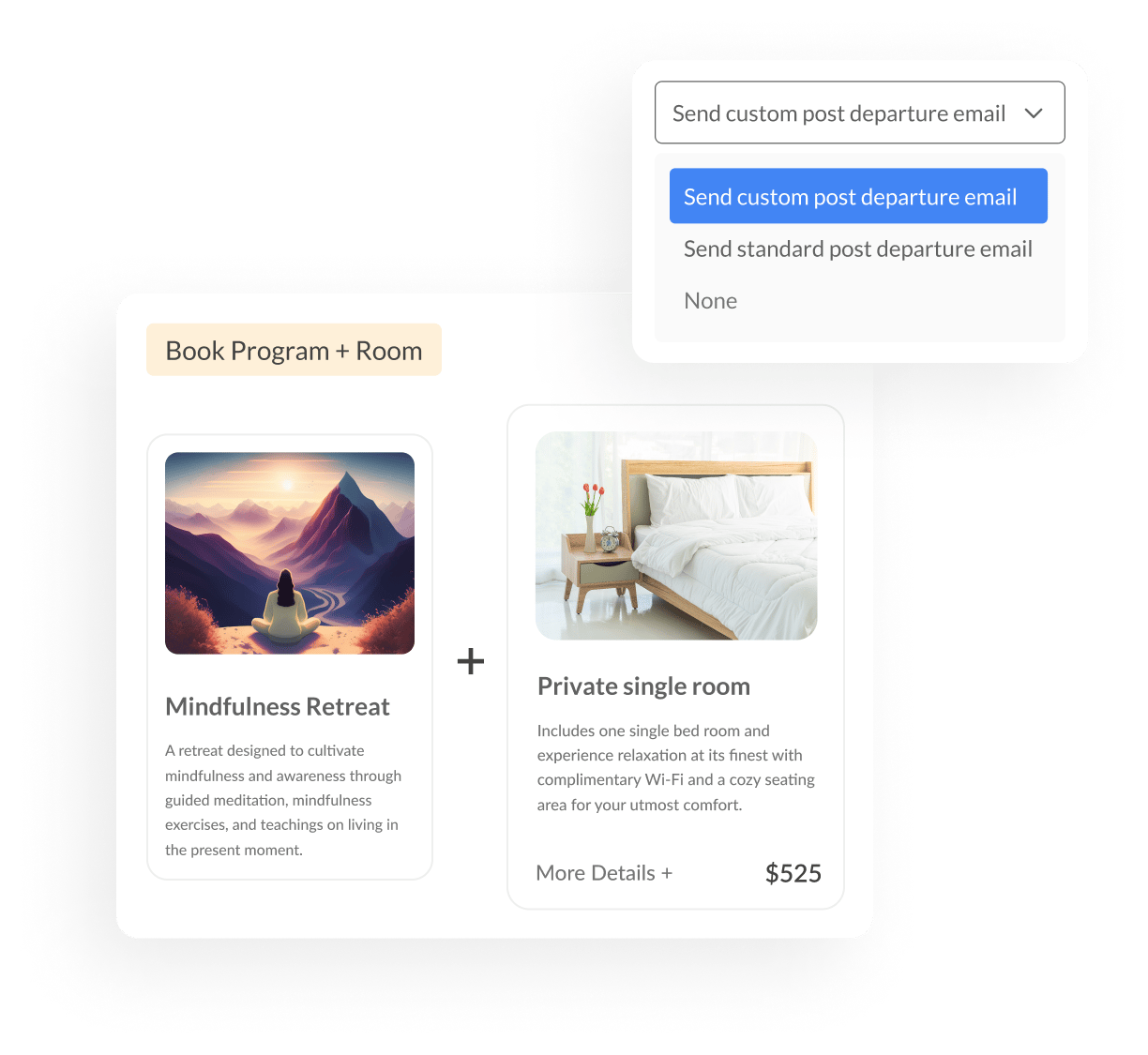

Access Unique Data & Better Reports

Uncover trends and information about your retreat business by accessing data & reports specifically for retreats

- Build Custom Reports Based on Your Favorite Searches

- Schedule Your Housekeepers With Ease

- Get Daily Diet-Based Meal Reports for Your Kitchen

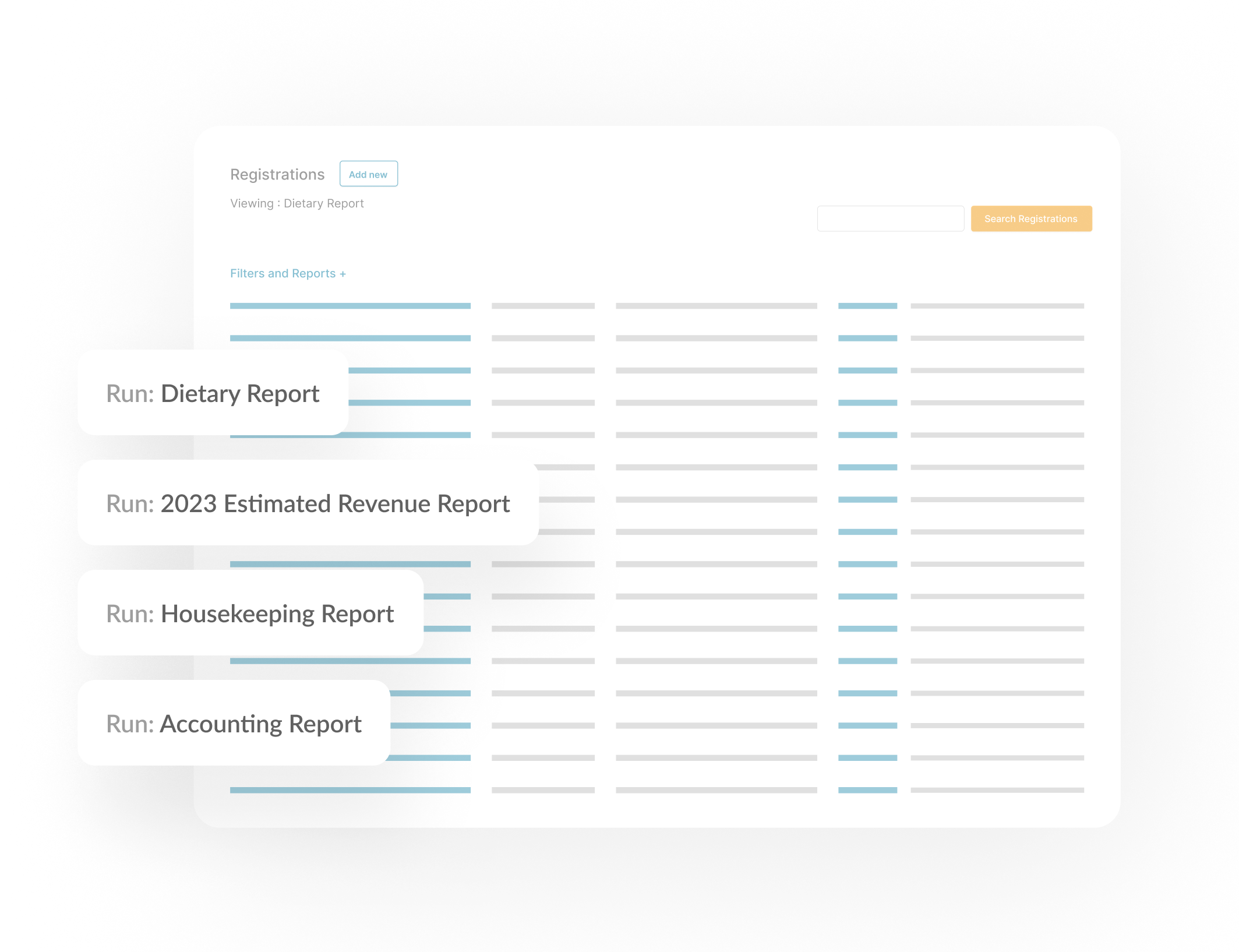

Keep Everyone on the Same Page

Make sure your entire team stays in sync by having all of your retreat data and information safely stored in one place.

- Track All Changes to Registrations Over Time

- Turn Spaces Into Venues That Can Be Viewed in a Calendar

- Add Notes, Statuses & Colored Flags to Your Programs & Registrations

What Our Customers Think

Retreat Guru works with retreat centers around the world. Our goal is to help them share their love, light, and teachings with participants so that they can embark on their own journey of growth, acceptance, and enlightenment.

How to Get Started With Retreat Guru

01

Meet With a Member of Our Team

Fill out this form to book a demo with a member of our team. They will guide you through the software while learning more about your retreat business.

02

Select the Right Subscription Plan

We will look at the annual revenue and volume of your retreat business to see which subscription plan is the best fit.

03

Meet With One of Our Onboarding Specialists

Finally, you will connect with one of our onboarding specialists who will be your guide in setting up Retreat Guru to meet your needs.

Trusted by Retreat Centers Around the World

Retreat Guru Users

We work with retreat centers of all sizes and across all disciplines. Here’s what some of our customers have to say.

“I have been using this software now for over seven years and it’s a game changer. It streamlines everything — giving you so much time to focus on other areas of your business. Best investment I’ve ever made!”

Lulu Agan

Owner, SwellWomen

"I have been offering retreats with RetreatGuru since 2016. It is incredible software and support, a heart centered team who always helps to find a solution. Can't recommend enough for retreat leaders and retreat participants."

Joel Altman

General Manager, Hariharalaya

"The features are easy to use and we were able to cut our time in half with your Rentals software. I love that it's all hooked together AND that it's easy to use."

Brian Fulp

Director, Himalayan Institute

Software Built for Running Retreats

See how Retreat Guru’s all-in-one retreat management software will make it easier to run your retreats.

Book a Demo